I Am Looking for Reviews on Top Health Plans

We looked at an extensive list of long-term care insurance companies and selected our top five. When making this evaluation, nosotros looked at a variety of factors including how transparent the insurance companies were with data, flexible long-term intendance insurance plan offerings and customer feedback. Our pinnacle v choices for the all-time long-term intendance insurance companies are Common of Omaha,Transamerica, OneAmerica, National Guardian Life and Lincoln Financial. In this guide, we will requite you tips for ownership long-term care insurance, answers to often asked questions well-nigh this type of insurance and detailed evaluations of each of our top company picks.

Top Long-term Care Insurance Tips:

- Long-term care insurance policies vary quite a bit, especially past state, then understand what the policy does and does not cover.

- Make a realistic cess of your needs using an online figurer or long term intendance specialist, so your selected plan is non underfunded.

- Always become quotes from multiple companies.

What to Know About Long-term Care Insurance Companies

Understand Long-Term Care Insurance Limits

Lesson

Enquire questions if you don't understand programme limits.

Long-term care insurance plan benefits have limits on how much each policy pays out for various types of services. Some of the critical program limits you need to know are:

- The maximum amount per day or month the plan will pay

- How long the policy volition pay out

- The policy lifetime maximum

Insurance companies arrive at the lifetime maximum amount by multiplying the daily maximum payout by the length of the policy limit. Plans vary widely on the blazon of care covered. Under comprehensive plans, care is usually covered up to a maximum daily rate for assistance in nursing homes, assisted living facilities, developed day care centers and memory care facilities. There may be restrictions on coverage for care received in the senior's home. Skilled nursing care, therapy visits, and activities of daily living help are all usually covered under long-term care insurance.

Plan for Futurity Long-term Needs

Taking a wild guess nearly how much long-term care coverage you need is a risky manner to decide on a policy. The boilerplate national monthly cost for domicile intendance is over $4,099 per month and nursing home care is close to $8,000 per month.

Lesson

Exist certain your funding level reflects the type of care yous expect.

When you buy long-term care insurance, you need to choose a funding level. This funding level is the amount of money you lot look to need to encompass your long-term intendance expenses. Before y'all make up one's mind on how many years of funding to buy, consider your health and expected longevity. At that place are life expectancy calculators available, but yous'll too need to think near your futurity health and family health trends to get a feel for the levels of care yous will probable require down the road. For instance, if your family has a history of dementia, you should probably program for retentivity intendance. Likewise, if your family has a history of living for an unusually long time y'all may desire to set for the extra fourth dimension care may exist needed.

You also need to consider how you will likely be living when y'all start using long-term care insurance. Costs and services vary widely depending on whether you alive at dwelling with assistance, in a skilled nursing facility, or in another senior intendance facility. You need to know where and how you want to live to ensure there is acceptable funding for your after years. For instance, assistance with daily living in your home volition generally cost less than total-time care in a nursing abode. If you expect Medicaid to embrace a nursing home once you lot crave total-time nursing care, you could buy enough long-term care insurance to cover in-home nursing expenses for five years or so before you anticipate going into a nursing home.

| Cost of Long-Term Care in the U.S. | ||

|---|---|---|

| Blazon of Care | Daily Cost* | Annual Cost |

| Developed Day Care | $68 per twenty-four hours | Varies. $17,000 to $eighteen,000 if attending daily all twelvemonth round. |

| In-Home Intendance or Personal Assistance | $20.50 per hour / $164 per twenty-four hours | Varies on number of days per calendar week assistance and care is scheduled. |

| Assisted Living Facility | $119 | $43,536 |

| Nursing Dwelling house, Shared Room | $225 | $82,128 |

| Nursing Abode, Private Room | $253 | $92,376 |

*Figures from Genworth'due south annual Toll of Long-Term Care Survey

Plan for Inflation

Lesson

Be sure your long-term care insurance coverage grows with aggrandizement.

I of the good things nearly long-term care insurance, when compared with life insurance is, unlike life insurance, it provides an inflation do good. At the time you buy long-term intendance insurance, $200 a day might pay for the level intendance you wait to need subsequently in life, but will that be enough when you need to use the insurance? How much will care cost many years downward the road? Some plans accept the option of adding an inflation aligning to help keep up with inflation. This selection increases the daily benefit and policy lifetime maximum each year based on a percent.

This ways if yous buy a $300,000 long-term care policy at historic period 65 with a three pct inflation option, you lot're looking at a payout of around $500,000 when you lot striking 85 years old, when you are more than likely to need long-term care. A regular life insurance policy would remain at $300,000.

A compound involvement selection is preferable to a simple interest, which grows your benefit more slowly. Compare this concept to unproblematic and chemical compound interest in a savings business relationship. Simple interest is only calculated based on the amount you deposit into the account. Compound interest, however, is calculated each period based on the sum of deposits plus previously-earned involvement.

Know When the Policy Activates

Lesson

Review the program activation requirements before purchasing a long-term care policy.

The federal government defines activities of daily living (ADLs) to accept a standard descriptor for government and private insurance programs. ADLs include bathing, dressing, transferring (moving from bed to a chair or toilet and back), eating, and incontinence care. Long-term intendance policies actuate if you demand aid with ii out of the 6 standard activities of daily living. This aid tin can be provided in your dwelling house or an assisted living setting equally well as a nursing dwelling house.

Why Yous Need Long-Term Intendance Insurance

Insurance is used to defray the cost of possible expenses that could liquidate your savings or have an touch on on family members' finances. The chance of needing care later in life is very high, so it's a practiced idea to consider making long-term care insurance a part of your financial plan to accept peace of heed and to be able to receive the level of intendance you desire.

The U.S. Department of Wellness and Human Services released a comprehensive report in 2014 afterwards researching concerns related to long-term health intendance by surveying xv,298 adults anile twoscore to lxx years sometime. The study found that while most adults do not have a firm agreement of long-term care insurance, they accept many concerns with aging. Chance are, you lot share these concerns, listed below.

| Survey of Long-Term Care Awareness and Planning Aging and Disability Concerns* | |

|---|---|

| Concern | Per centum of Respondents |

| Losing independence | ninety.lx% |

| Becoming a burden to family unit | 83.50% |

| Losing control of choosing a level of long-term care insurance | 83.30% |

| Beingness unable to depend on family or friends for help or care | 65.thirty% |

*Findings from the Survey of Long-Term Care Awareness and Planning Enquiry Brief

Our Search for the All-time Long-term Care Insurance Companies

i. We searched multiple long-term care insurance companies

2. We evaluated these companies based on our expert-guided buying criteria: customer experience, program options, and transparency of information

3. We provided you the best long-term care insurance companies for consideration

The approach we took to narrow downwards the pinnacle long-term care insurance companies was as follows:

- We looked at multiple long-term care insurance companies

We began our search with 20 long-term care insurance companies – some familiar and others not so familiar. We researched each company's products and plans to come across what they cover.

- Nosotros checked with experts

We analyzed long-term care insurance companies based criteria laid out by the Administration on Aging. We also looked at things to know earlier choosing a long-term intendance policy put out past the U.S. Department of Health and Human Services.

- Nosotros listened to consumers

We narrowed our list by using companies that had high ratings on online customer review sites. We found and removed companies who had a large number of negative reviews.

- Nosotros put the best companies on your radar

Our final list of long-term care insurance companies meet the criteria listed higher up and is a bang-up starting indicate to base your search when shopping for long-term care insurance.

Long-term Care Insurance Company Reviews

While long-term care insurance providers take drastically reduced in numbers over the concluding few years, there are still many companies providing coverage. We sorted through the data for you. Our in-depth long-term intendance insurance analysis goes deep into what each company offers to clients forth with customer feedback. We and so culled down the list based on specific criteria defined by what matters near to consumers. The result was a list of the top five best long-term care insurance companies: Mutual of Omaha, Transamerica, OneAmerica, National Guardian Life and Lincoln Financial. Each of these companies stood out from the competition.

Mutual of Omaha Long-Term Care Insurance Review

Great Policy Discounts |

Common of Omaha was founded in 1909, hitting $1 billion in benefits paid to clients in 1958. It has been on the annual Fortune 500 list for over twenty years and holds the highest financial stability ratings from Moody's, AM Best and Standard & Poor's.

Mutual of Omaha Savings

We chose Mutual of Omaha for its policy discounts which include xv to 30 percent off your long-term care policy. Nosotros too like its flexible MutualCare long-term insurance solutions which are designed to protect your retirement assets. MutualCare Secure and MutualCare Custom are traditional long-term care insurance options.

MutualCare Secure Solution is a traditional long-term care policy offer $1,500 to $10,000 in monthly benefits for a nursing dwelling house, assisted living, adult day care and in-home care expenses. Information technology is all-time for those who prefer easy-to-understand benefits and are comfortable with a certain level of asset protection.

MutualCare Custom Solution is a traditional long-term care insurance policy that is highly customizable. It is best for those who want to exist very specific with long-term care planning.

Types of covered care: in-home care, assisted living/adult daycare, nursing home, respite, hospice and medical help systems.

Policy options bachelor: Innovative inflation protection, nonforfeiture, return of premium up on death, monthly benefit, shared care benefit, full restoration of benefits, joint waiver of premium and emptying flow credit riders.

The Meliorate Business Agency accredits Mutual of Omaha and gives the company an "A+" rating.

To receive a Mutual of Omaha quote, visit their long-term care insurance website or call 877-882-7556.

Read our full Mutual of Omaha Long-Term Care Insurance review for more than details.

Transamerica Long-term Intendance Insurance Review

Groovy Build-Your-Ain Policy |

Transamerica serves 13 million customers in the The states with headquarters in Cedar Rapids, Iowa, and employs nearly thirty,000 people worldwide. Transamerica Life Insurance Company holds a license in every state and currently holds $ane,018 billion in insurance policies while receiving high financial stability ratings. Aegon, Transamerica'due south parent company, has a runway record spanning over 170 years and a balance sheet with nearly $1 trillion in investments. Transamerica offers several optional benefits to heighten TransCare Three Long-Term Care policies, assuasive adults of almost any age to fine-tune coverage to best suit their needs.

Transamerica Financial Strength

We like Transamerica for its build-your-own policy which includes a maximum daily do good of $50-$500 and policy maximum corporeality ranging from $36,500 to $ane,095,000. Information technology as well offers over seven riders from which to choose.

Types of covered care include: in-habitation care, assisted living/developed daycare, nursing dwelling, respite, hospice and medical help systems.

Policy riders bachelor: nonforfeiture, return of premium up on death, monthly benefit, shared care benefit, total resotration of benefits, joint waiver of premium and elimination period credit riders.

Transamerica holds a "B" rating with the Amend Business Bureau and hold an "A" or better fiscal strength rating with A.K. Best, Fitch, Moody's and S&P Global.

To receive a Transamerica quote, visit their long-term intendance insurance website or call 888-997-4074.

Read our comprehensive Transamerica review for more details.

OneAmerica Hybrid Long-term Intendance Insurance Review

Great Hybrid Policy |

OneAmerica has been providing financial services across the U.s. for over 140 years. 7 companies operate under the OneAmerica umbrella, with The Land Life Insurance providing asset-care long-term care insurance and other products to help manage the cost of long-term intendance. One reward OneAmerica offers with Nugget-Care plans is beneficiaries receive a payout if yous never need long-term intendance before you dice. While long-term care insurance is however evolving, many policies offer no payout or asset transfer should you dice without needing to use your benefits.

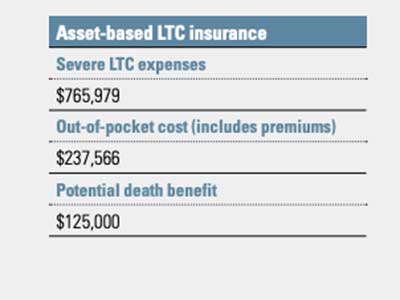

OneAmerica Nugget-based LTC insurance

We like OneAmerica for its hybrid nugget-care policies which are based around life insurance or annuities. A hybrid policy based around an annuity tin can provide you with tax-complimentary long-term care benefits.

Types of covered care include: in-dwelling house care, nursing care, assisted living, respite, hospice and more.

Policy riders available: Return of premium, death benefit, base policy inflation protection rider, Asset-Care Plus rider, Annuity Care Plus Continuation of Benefits for LTC Pick, Annuity Payment Increase option, refund options, waiver of premium

OneAmerica has a strong financial strength rating with an "A" or an "A+" ranking from institutions like A.M. All-time and Standard and Poor.

To receive a OneAmerica quote, visit their long-term care insurance website or call 888-671-8789.

Cheque out our full OneAmerica review for more details.

Additional Long-term Care Insurance Companies

-

New York Life: New York Life uses a confront-to-face consultation with highly-trained insurance professionals instead of finalizing long-term care insurance policies online. Read our full New York Life long-term care insurance review.

-

GoldenCare: GoldenCare is part of National Independent Brokers, Inc. and is an insurance brokerage firm offering long-term care insurance and other plans from a variety of insurance providers. In the Western part of the country, GoldenCare operates nether the name American Independent Marketing. Read our full GoldenCare review.

-

Transamerica: Transamerica Long-term Care has helped build more secure futures for more than than 571,000 individuals; Paying in excess of $5.7 Billion in claims as of December 2018. Read our full Transamerica review.

Related Long-term Intendance Insurance Resources

Readers of this Long-term Intendance Insurance guide too found these related articles helpful.

![]()

![]()

![]()

Types of Long-term Care Insurance

If you think you'll demand help paying for long-term care during retirement merely don't know a lot most long-term care insurance policies, read near some of the nigh mutual types here.

Long-Term Intendance Insurance Companies By State

- Washington

Ofttimes Asked Questions about Long-term Care Insurance

Why practise I need long-term intendance insurance if Medicare covers nursing home care?

Medicare merely covers some nursing habitation costs, usually only for short-term stays in nursing facilities. Medicare does not pay for help with activities of daily living (ADL) intendance.

Does Medicaid cover nursing habitation intendance?

Medicaid pays for nursing home care in most states, only only after seniors spend downwardly almost all assets to fund nursing care. If you transfer avails to another person inside five years of applying for Medicaid, you will be ineligible for Medicaid long-term care benefits because your assets could have been used to pay for the nursing abode expenses. For instance, if y'all deed your home to an adult kid a year before y'all demand to go into a nursing domicile, Medicare can deny coverage until the house is sold and used to pay for care.

What should I know well-nigh hybrid long-term insurance plans?

Y'all pay for regular long-term care insurance each month or year, depending on your plan, and the policy remains in effect as long equally you make the payments. With a hybrid policy, your premium payment tin can exist a "one and done" deal considering you tin can link your long-term care policy to a paid-up life insurance policy or annuity. Using the linked financial instrument, you can make payments from a unmarried payment up to 20 years depending on the insurance company upfront for your long-term care insurance.

If you do not make an upfront payment for a hybrid programme, yous can elect to pay premiums on a regular ongoing basis, and different regular long-term care insurance, those premiums will never increase. The payments are likely to be higher compared to regular long-term care policy premiums, but it's much easier to budget for equal payments.

Another feature of many hybrid long-term care insurance policies is that you can choose from a variety of benign features, such as unlike benefit periods, inflation protection options, and the level of monthly benefit payout.

One of the best features of hybrid long-term care insurance is that you get your premiums refunded if y'all never need to use your insurance. If you lot found beneficiaries, they will receive a refund of your premiums less any long-term care costs covered over the length of the policy.

Are premiums guaranteed?

Long-term intendance insurance premiums practice non alter based on private conditions between renewal terms. Still, long-term care insurance providers can raise premiums on groups of policies but only afterward they are granted approval by each land insurance regulator. Ultimately, the insurance company must prove the demand for a rate increment to each state insurance regulator and only the insurance regulator has the authority to corroborate the amount of a charge per unit increment and on which groups of policyholders. While many people who purchased LTC policies 5-10+ years ago take seen rate increases, the products sold today accept a much lower chance of requiring a rate increment as the insurance companies have learned from the past and insurance regulators have go far more restrictive in blessing charge per unit increases.

My employer offers long-term care insurance as a benefit. What happens when I retire or go out my job?

Companies are not required to keep paying for coverage for y'all when you lot leave employment. Legally, however, you can accept your policy with you after retirement equally long as you lot continue paying for the plan.

Is there a benefit limit to long-term care insurance?

Yes, like all insurance, there are policy limits. When shopping for long-term care insurance, know the full limit of funds a policy will pay.

What is the elimination menstruation?

Most long-term intendance plans include an elimination period of 1 to three months where you pay out-of-pocket before the policy starts paying for care. The elimination menses is like to deductibles related to health intendance insurance and are used to ensure that long-term intendance insurance plans practice non pay for curt-term care.

Concluding Thoughts on Long-term Care Insurance

Bottom Line:

Take the time to make sure you're purchasing a long-term intendance insurance policy that fits your exact needs.

The U.S. Department of Wellness and Human being Resources reports that someone turning 65 today has a 70 per centum chance of needing some grade of long-term intendance during their lifetime. Twenty per centum of these people volition need intendance for longer than five years, but Medicare only covers 22 days on average of nursing home care. Medicaid won't begin picking upwardly costs until the senior has used near all assets to pay for long-term intendance expenses, and then intendance choice is severely limited. With these staggering statistics, planning for long-term intendance needs is a financial necessity.

Best Long-term Intendance Insurance Companies

| Long-term Intendance Insurance Company | Best For | |

|---|---|---|

| one | LTC Consumer | Great Broker |

| 2 | Mutual of Omaha | Great Policy Discounts |

| 3 | OneAmerica | Dandy Hybrid Policy |

| 4 | National Guardian Life | Great Plan Benefits |

| five | Lincoln Financial | Great Policy Protection |

| six | Nationwide | Great Cash Reimbursements |

kimbrellthelismor2002.blogspot.com

Source: https://www.retirementliving.com/best-long-term-care-insurance

Post a Comment for "I Am Looking for Reviews on Top Health Plans"